Appearance

The sale analysis "commercial" panel

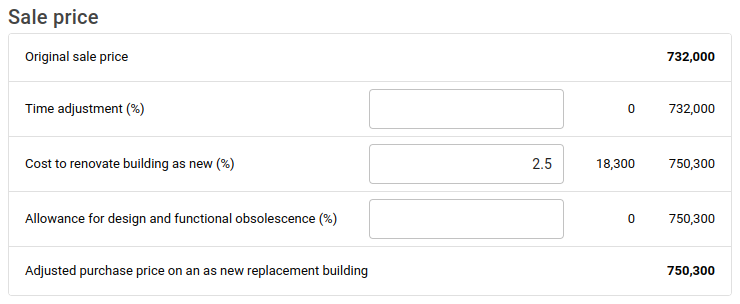

Sale price

This is what the panel looks like:

Do not enter the % sign into the entry fields. If you do, the system will divide the value by 100.

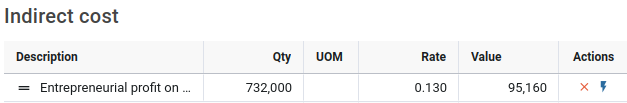

Indirect costs

The row with a description that reads Entrepreneurial profit on construction will have an extra operation  button at the end.

button at the end.

If you click on the operation  button, the system will subtract the total replacement cost from the adjusted purchase price and put the result in the Qty column of this row, and rerun the calculations. If you want to specify a required percentage profit, specify this percentage as a decimal number (so the 0.13 in the table above means 13%), and the value will be calculated for you.

button, the system will subtract the total replacement cost from the adjusted purchase price and put the result in the Qty column of this row, and rerun the calculations. If you want to specify a required percentage profit, specify this percentage as a decimal number (so the 0.13 in the table above means 13%), and the value will be calculated for you.

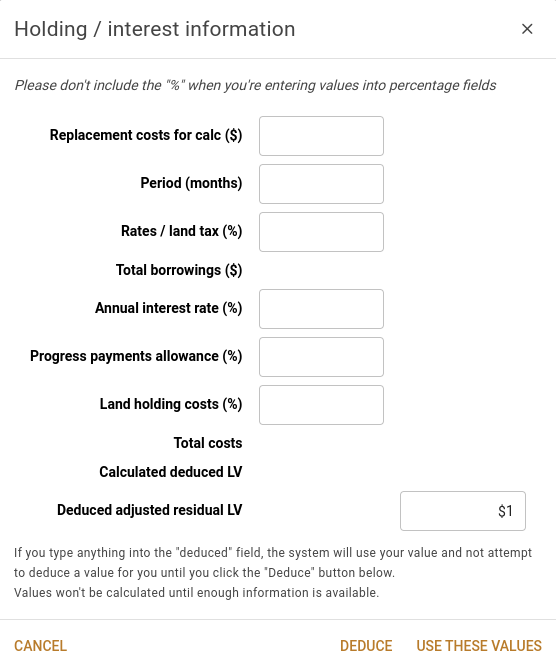

Holding costs / Loss of interest

There is an Enter holding/interest info button to the right of the Holding costs heading. If you click this button, you'll see a popup similar to this:

Again, do not enter the % sign into the entry fields. If you do, the system will divide the value by 100.

The system will copy the total from the Replacement cost section into the top value of this popup, but you'll need to enter the rest of the values yourself.

| Item | Description |

|---|---|

| Period (months) | Enter the number of months that redevelopment is going to take |

| Rates / land tax (%) | Enter the percentage of the value charged by government bodies during the redevelopment period. Note that the system will calculate this to be $0 to start with, since the percentage is applied to the deduced land value, but we haven't deduced that yet. |

| Annual interest rate (%) | Enter the cost of financing the redevelopment. |

| Progress payments allowance (%) | Enter 50 since half of the cost will be defrayed by progress payments. |

| Land holding costs (%) | Enter the annual percentage of the cost of holding the land. |

The calculated values that show up are as below.

| Calculated Value | Description |

|---|---|

| Rates / land tax | Deduced adjusted residual LV (DARLV) x the statutory charges percentage x the period (in years). |

| Total borrowings required | The sum of the replacement costs and the statutory charges. |

| Progress payments allowance | The annual interest rate x the period (in years) x total borrowings x the progress payments allowance percentage. |

| Land holdings cost | The annual interest rate x the period (in years) x the DARLV. |

| Calculated deduced LV | The adjusted purchase price from the main page – the replacement costs from this popup – the total indirect costs from the main page – the total costs from this popup. |

You won't see all of these values until you've entered sufficient values to calculate a deduced LV.

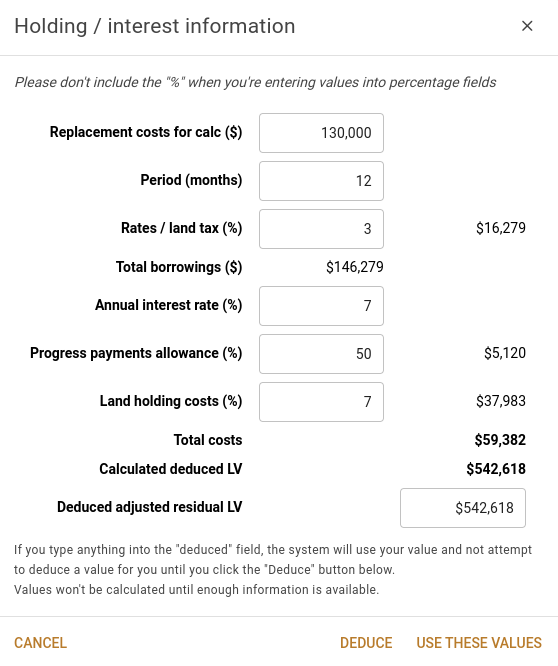

Once you've entered enough information, the system will determine the calculated deduced LV. The problem is that various items contributing to the deduced LV depend on the value of the deduced LV. So what the system does is guess at the DARLV, and compare to the calculated one. If they're different, it picks a DARLV that is midway between the two values and tries again. It does this until it can't get the two values any closer, and then presents them. This takes pretty much no time, and you'll end up with a popup looking like this:

At that point, you can click the Use these values button, and the system will generate the following lines in the main page. Note that the information below reflects the information that was put into the form above. Data values in the points below are calculated based on input values entered into the popup.

- Holding costs

- Description: Council/water rates and land tax over 12 months @ 3%; Value: 16,279

- Loss of interest

- Description: Finance on $146,279 for 12 months @ 7% with allowance for progress payments; Value: 5,120

- Description: Land holding costs for 12 months @ 7.00%; Value: 37,983

Clicking the Use these values button will result in the system removing all other rows from the Holding costs and Loss of interest tables, and replacing them with the generated text.